Article written by Vinicius Morais.

APIs, or Application Programming Interfaces, are a way to integrate systems, enable benefits such as data security, ease exchange of information between different programming languages, and monetize access to valuable data.

APIs provide the integration between distinct systems in an agile and secure way. The possibilities provided by the use of APIs allows the connection of heterogeneous technologies, such as different databases, programming languages or operating systems. Also, one can make application-specific features and tools available to others with ease.

APIs are queries to data and operations through exposed services. APIs enable banks to provide customer information to fintechs securely by maintaining the privacy of sensitive data, thus enabling the growth of innovative financial services and, ultimately, wealth generation. By releasing an interface or API, financial institutions enable developers, partners, software companies and fintechs to gain access to the financial infrastructure of the institution that is essential for the operation of new systems and products.

Though banks and credit unions are often thought of as traditional institutions, the APIs they provide are the key to innovation for fintechs. Some banks have sophisticated API initiatives that allow developers to register on the institution's website and, once approved, access data to create solutions on behalf of the institution. Open APIs are made freely available, while closed APIs are available only to partners or members of select incubators. Fintechs also have the ability to utilize services like Plaid, to leverage customer data across a range of institutions and use cases.

PayPal began the open banking revolution back in 2004 when it launched the PayPal API. This API allowed other companies to connect and gain access to their business information, allowing collaboration between financial institutions and fintech companies, thus launching the fintech boom.

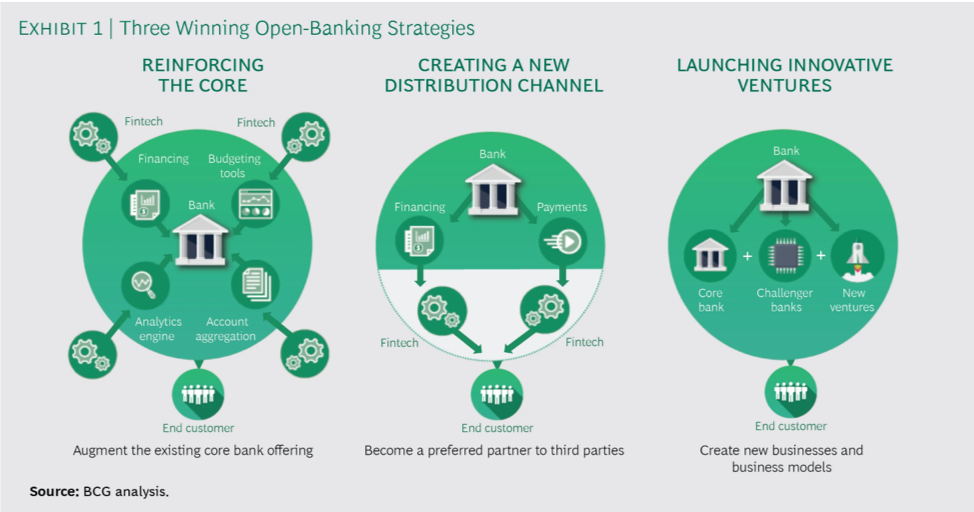

A report from Boston Consulting Group describes three winning open banking strategies and five areas where fintechs are prioritizing customers demands for new solutions.

Open Banking strategies

- Reinforce the core: Layer functionality, services, and innovative offerings on top of the core system maintained and operated by the bank, while acquiring market share from less responsive competitors. In this scenario, banks do what banks do best (core functionality) and fintechs do what fintechs do best (innovative solutions based on customer needs).

- Creating a new distribution channel: As they mature, the most successful fintechs will open up third party networks that banks can leverage as important new channels for their products and services.

- Launching innovative ventures: APIs and third-party relationships can help banks rapidly build disruptive new business models by combining features and functionality from third parties.

Areas where fintechs are prioritizing new solutions based on customers’ demands

- Personalized Savings: Help customers gain insights into how their behavior affects their finances, and how to maximize goals

- Personalized offers and programs: Provide tailored rewards from merchants of interest

- Personal financial management aggregators: Let customers monitor and transfer funds across banks and accounts

- Account-to-account mobile POS payments: Provide secure smartphone-enable digital payments at a merchant’s POS

- Instant POS consumer Loans: Provide consumer loans and demand at the POS

All of these strategies are focused on attracting innovative ideas that allow banks to stay competitive and become their customers’ partner of choice, providing fintechs critical and customizable integrations that become the basis for disruption and competitive differentiation.

Users want a complete digital experience, with access to their financial data integrated into their digital journey. Those who do not embark on this digital transformation in the next few years will struggle to stay relevant in the ever evolving market.

Core10’s API Development Expertise

Core10 has extensive experience in creating APIs for our banking and fintech clients, as well as utilizing existing APIs to connect systems. Our agile development approach and knowledge of core banking systems, as well as connectors such as Plaid, and Quovo, make us a great partner for banks and fintechs alike.

APIs are just one of Core10's many core competencies. To learn more about our tech stack, please see our Tech Radar here.

.jpg)