Investing in software development, product development, and application modernization is critical to maintaining your competitive advantage and driving employee and customer satisfaction through a rapidly evolving tech landscape.

IT directors are very familiar with company technology and software needs but finding the budget to design, develop and source talent for these projects is no easy task. Paying in a lump sum or CapEx style presents unique challenges while OpEx or over-time resourcing offers more flexibility to creatively assign and stretch budgets.

Understanding the nuances of CapEx vs. OpEx in IT projects is essential for making informed financial decisions. Paying in a lump sum or CapEx style presents unique challenges while OpEx or over-time resourcing offers more flexibility to creatively assign and stretch budgets.

Now, let’s take a closer look at CapEx (meaning capital expenditures) and OpEx (meaning operational expenditures).

Scoping with CapEX and OpEX in Mind

As you evaluate a new project’s requirements, take time to identify financial resources for each aspect of the project.

Not every dollar can be capitalized.

For example, the design and build of a project asset may make sense to capitalize because they offer long-term financial value to the business.

On the other hand, administrative costs like project management and implementation resources may not be capitalized. These aren’t assets that provide direct, long-term financial value.

Not only does this assessment help the client determine optimal funding, upfront transparency ensures that both client and provider are confident with the budget as the project moves forward.

Challenges Facing CapEx and the Lump Sum Purchase

CapEx approaches new software development as a lump-sum investment with a depreciable lifetime value. The strategy is traditional in nature and while it views each project as a clean, one-time investment, there are some limitations but it’s not all downside either (scroll down to mixed models for upsides).

The first challenge for CapEx funding involves building a budget that forecasts spending in a way that leaves little room for project managers to shift budgets on the fly. Forecasting budgets so far in advance is often shortsighted, limiting in-the-moment decisions that will benefit the final product.

Convincing upper management and board members to approve a single large budget is also a major hurdle for CapEx funding. Every small accounting detail is pre-planned and approved before the project begins. Building the budget and proposal can be an expensive endeavor in itself.

Next, IT managers must pitch the project as a single lump-sum investment to the board. In some cases, this requires justifying high six- and seven-figure numbers for a one-off spend. In the modern digital landscape, SaaS and IPaaS offer attractive alternatives where spending is expensed operationally and not as capital expenditures.

Getting Creative with OpEx

Where CapEx is limiting, OpEx style spending excels in the modern digital landscape. The approach allocates budget as operational expenses, making it easier to stretch them over longer periods of time. IT managers are not required to have large, single expenditures approved and they can break down monthly or quarterly development spends for short-cycle approvals.

Flexibility is one attractive reason for choosing OpEx. Every month is different in terms of spending needs and this model accounts for those variables. When utilizing the right outsourced software development partners, IT managers can save when workflows are light and spend when they need resources to hit goals. Reducing wasted spending in a more efficient development environment is much easier to pitch and approve from a board perspective.

OpEx expenses sit within the income accounting category and remain tax-deductible across the entire year. The ongoing budgets can work for SaaS subscriptions, direct outsourcing, in a staff augmentation or project-based arrangement. Lower costs are sometimes associated with OpEx (not always) because the budgets are relative to short-term spending cycles.

CapEx vs. OpEx – Mixing the Models for IT Projects

Both CapEx and OpEx have limitations when used as a single strategy. Mixing the two models to maintain the right balance is a creative means of maximizing budget reach and impact on the project.

Accounting departments may also see the move as advantageous because the capitalized aspect of the project remains a depreciable asset while the operational budgets empower the dev teams to work strategically and not against rigid one-off budget allocations.

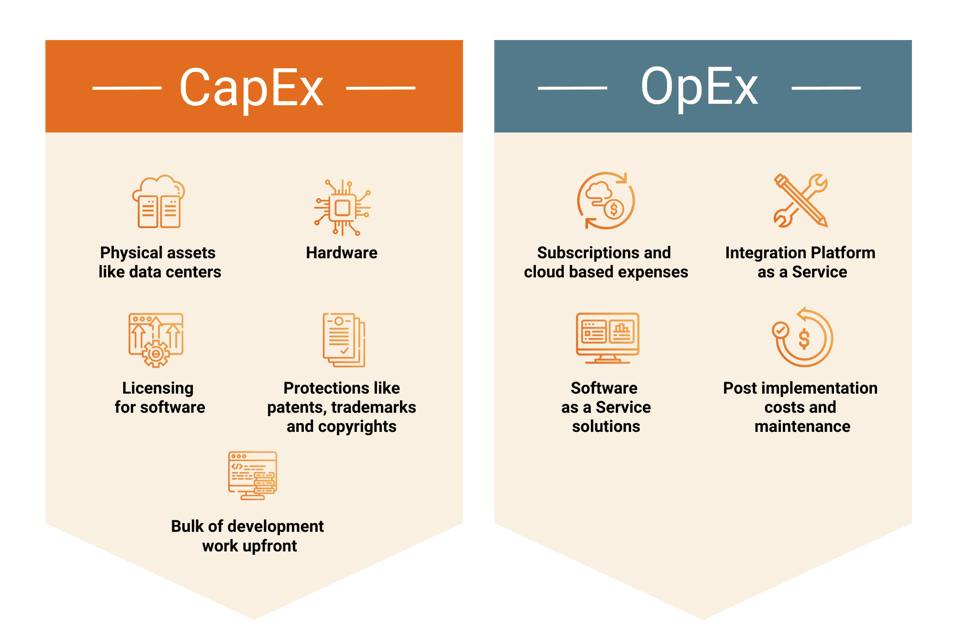

Use CapEx to:

- Purchase physical assets like data centers

- Invest in hardware (depreciable investment)

- Purchase licensing for software

- Invest in protections like patents, trademarks, and copyrights

- Finance the bulk of development work upfront

Use OpEx to:

- Fund subscriptions and cloud-based expenses

- Engage IPaaS to drive development

- Purchase SaaS solutions

- Fund post-implementation costs and maintenance

One Core10 client used a split strategy to capitalize their upfront development costs while expensing training costs, post-implementation expenses, and data conversions beyond their initial capital expense planning. Like many companies in their shoes, they needed to maximize their budget to support a large software modernization effort. Dividing costs and working with their accounting department made it possible to secure upfront development funding without a massive budget approval because ongoing expenses were distributed operationally.

The advantages of using this approach are clear, especially for larger projects with complex budgetary needs. Smaller or ongoing projects can benefit from a simple OpEx expenditure style that works efficiently in the monthly and quarterly operating budget cycles and in some instances, CapEx is the better solution.

Core10 works with both CapEx, OpEx, and mixed models to work within the ideal financing framework for each project.

Maximizing IT Budgets with Mixed Models

Using a mixed model serves to create a more nimble and effective IT approach to resourcing and budgeting software projects. Understanding the differences between CapEx and OpEx and working with your accounting department to plan serves the company’s bottom line alongside your specific IT needs.

Take the time to plan ahead while leaving operational budget available to move quickly on high-priority project segments. In the end, you can get more from your budget using these creative funding solutions.

How will you fund your next IT project?

Core10 works with partners to deliver software development talent. The Core10 model ensures every project is resourced in a way that delivers the best service to fit your budget, project, and general business model. Get in touch to discuss creative budget solutions and development strategies for your next project.

CapEx, or Capital Expenditure, refers to the funds used by businesses to acquire, maintain, or upgrade physical assets such as property, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments, allowing a company to expand its operational capacity.

OpEx, or Operating Expenditure, refers to the ongoing costs associated with the day-to-day operations of a business. This includes expenses like rent, utilities, salaries, and other routine operational costs. Unlike CapEx, OpEx expenses are fully deducted in the accounting period they occur.

For software companies:

CapEx: Typically involves expenses related to the development of new software products, acquisition of servers or data centers, or investments in long-term software licenses. These are seen as long-term investments that will provide value over time.

OpEx: Includes ongoing costs such as cloud service subscriptions, software maintenance, customer support, and regular operational expenses like salaries, rent, and utilities. These are recurring, short-term expenses necessary for the daily functioning of the company.

CapEx Financing: This involves securing funds for long-term investments in assets that will benefit the company over an extended period. This could be through loans, issuing bonds, or using retained earnings. The expenditure is capitalized, meaning it's spread out over the asset's useful life in the form of depreciation.

OpEx Financing: Refers to funding the ongoing operational costs of a business. These costs are treated as expenses in the income statement for the period they occur. OpEx financing often comes from the company's regular revenue streams or short-term credit facilities.